Why Break a Lease in the Seattle Area > 3 Big Reasons Why It Might Be a Good Idea

1) You’re Actually Gaining An Advantage By Entering the Market

It’s actually a smaller expense over the long run versus just looking at the cost upfront. Many people think about the small things instead of looking at the bigger picture. For example think about this:

What if your rent was $1850/mo and your landlord charges you 2.5 month’s rent to break your lease as a cost. That totals $5550 and you’re getting into a home valued at $450,000 and you’re putting 10% down ($45k) with closing costs of around 2% of this value ($9k).

**The $5,000 cost is very small compared to the $54,000 for your down payment and closing costs you’re investing in your home. Comparatively this is less than 10% of the expense you’ll have up front to enter the market. See below.

2) Think About Opportunity Cost and Future Unrecoverable Cost

Let’s say you’re entering the real estate market in the early summer when prices are typically still on the rise at 1% every 6 to 8 weeks. Over just one year by entering the market you’re going to gain (for example) 6% on your home valued at $450,000, making the new valuation at $477,000, for a gain of $27,000.

Then think about the rent you will have saved over the course of those 12 months which totals $22,200, again using the $1850/mo figure.

**So over the course of just one year you’ve gained $27,000 and KEPT $22,200 for a total of $51,200. Take away the $5550 lease breaking fee and you’re left with a OVERALL GAIN of $45,700

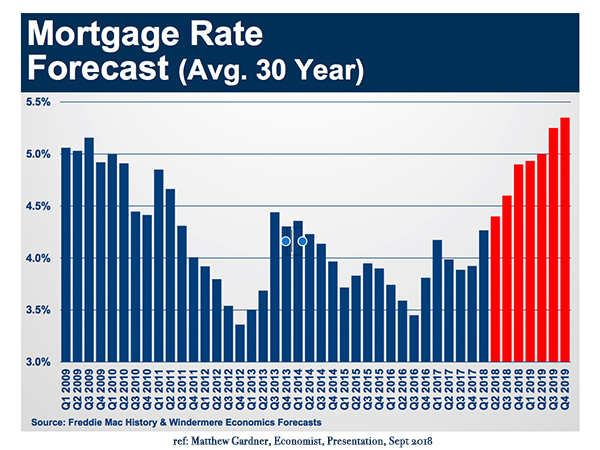

3) Interest Rates in 2018 and 2019 Will Be On the Rise

They’re slowly sneaking up from record lows back to a somewhat normal market and anything 5% to 6% is STILL a very good rate historically. It’s just that since the housing market crisis of 2008, for the economy to recover, rates were much lower than in previous times and everyone got to enjoy this for a whole decade. Now we’re on the rise and here’s what it means for you below.

**For every 0.5% a rate goes up, that’s $25,000 in ‘buying power’ that you’ll lose. So for every couple months you wait for things to be ‘perfect’, they’re actually less and less perfect at a rate that’s faster than you’ll be able to save.

* * * * *

Hopefully this was super helpful to you. Find this and more information by attending a class or contacting your Homebuying Specialist Julian Michael Aguirre today.

Have a great day!